Tendencias: Analizando la Imprevisibilidad de 2013 en LatAm

Debemos dar vuelta rápidamente a la hoja del balance de este vertiginoso 2012 que estamos dejando atrás y pensar en lo que podría venir con el objetivo de manejar eficientemente los recursos monetarios excedentes

por Diego M. Burzaco

por Diego M. Burzaco

Se trata de una frase muy habitual para describir el ritmo de los acontecimientos en cualquier ámbito de la vida, como si nunca tuviéramos momentos disponibles para hacer la pausa y reflexionar.

Quizás esta sensación es más extrema aún cuando nos ponemos el traje de inversor y nos embarcamos en la aventura de surfear los vertiginosos mercados financieros buscando poder defender el poder adquisitivo de nuestros ahorros y, por qué no, lograr una capitalización de los mismos.

Y esto es así. Porque cuando nos ponemos a analizar fríamente qué es lo que ocurrió en 2012, ya tenemos a 2013 pisándonos los talones. Y vaya que corrió agua bajo el puente en el año que estamos dejando atrás.

SIN TIEMPO PARA TOMAR ASIENTO

Los mercados son dinámicos, se mueven permanentemente, no descansan nunca y eso nos obliga a estar preparados para enfrentar lo que se viene, siempre con el mismo objetivo: defender nuestras inversiones y buscar la mejor forma de hacer crecer nuestro patrimonio.

Y si nos enfocamos en las perspectivas de un 2013 que está a la vuelta de la esquina, existen varias señales que podemos considerar al momento de establecer una estrategia de inversión.

Por un lado la Reserva Federal, el banco central de Estados Unidos, insiste con la necesidad de seguir apuntalando la actividad económica a partir del refuerzo de sus planes de estímulo monetario.

Con el mecanismo "Operación Twist" finalizado, que implicaba vender títulos de corto plazo y comprar los de largo para mantener las tasas de interés de más de 10 años en niveles históricamente bajos, la Fed decidió directamente expandir su programa de compra mensual a USD 45.000 millones a través de la adquisición de bonos largos, sin vender los de corto plazo.

Esto no es ni más ni menos que emisión monetaria lisa y llana, y una mayor oferta de dólares "garantiza" debilidad en el valor de la divisa para 2013, a excepción que surja un evento que dispare un pánico generalizado a nivel mundial.

Paralelamente, las tasas de interés continuarán bajas. No sólo la de los bonos del Tesoro estadounidense, debido a la mayor demanda por parte de la Reserva Federal, sino también la propia tasa de referencia de la entidad. Bernanke señaló que mientras la tasa de desempleo (hoy en 7,8%) se mantenga por encima de 6,5% y la inflación subyacente no supere el 2% anual, la Fed Fund Rate seguirá en los actuales niveles de entre 0% y 0,25%.

Aquí otra señal: no conviene comprar bonos a tasa variable ni bonos del Tesoro estadounidense si pretendemos obtener un rendimiento "decente" de nuestras inversiones.

Por el lado europeo seguiremos con la convulsión, adicionándose el hecho de que la que fue el contrapeso en 2012, la economía alemana, está en serios riesgos de ser arrastrada hasta la zona de recesión económica. Hay activos de valor allí, pero no todas las "ofertas" pueden terminar siendo un gran negocio.

China, en tanto, encara su recuperación tras varios trimestres de desaceleración económica. Se trata de buenas noticias para el mundo, pero también para los inversores. Las acciones chinas habían sido exageradamente castigadas por el mercado y sus valuaciones actuales parecerían representar una oportunidad, aunque debe primar la selectividad.

Asimismo, el hecho de que se motorice la demanda china es un punto a considerar para aquellas empresas que destinan gran parte de sus ventas a ese mercado. Aquí también puede haber una oportunidad.

¿Y POR CASA CÓMO ANDAMOS?

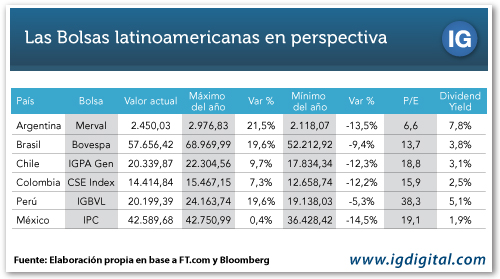

Según las proyecciones de la Comisión Económica para América Latina y el Caribe (CEPAL), la región verá una recuperación en 2013 respecto a la tasa de crecimiento de 2012, ya que proyecta un crecimiento promedio de 3,8% contra el 3,1% de este año que termina.

A nivel desagregado, si bien el organismo proyecta un avance

de la actividad económica en todos los países analizados, el crecimiento no

será uniforme. Las economías que liderarán los avances serán Paraguay (8,5%),

Panamá (7,5%), Perú (6%), Bolivia (5%) y Chile (4,8%).

En contraste, las tres economías más grandes de la región crecerán en torno al promedio: Brasil (4%), Argentina (3,9%) y México (3,5%).

De concretarse estas proyecciones, uno como inversor podría adelantarse a estos movimientos a través de una eficiente localización del dinero en aquellos activos que prometerán mayor retorno esperado. El gran escollo es que muchas veces lo proyectado no es lo que efectivamente termina ocurriendo en la realidad.

Fuente: Inversor Global